Cashflow management apps upgrade#

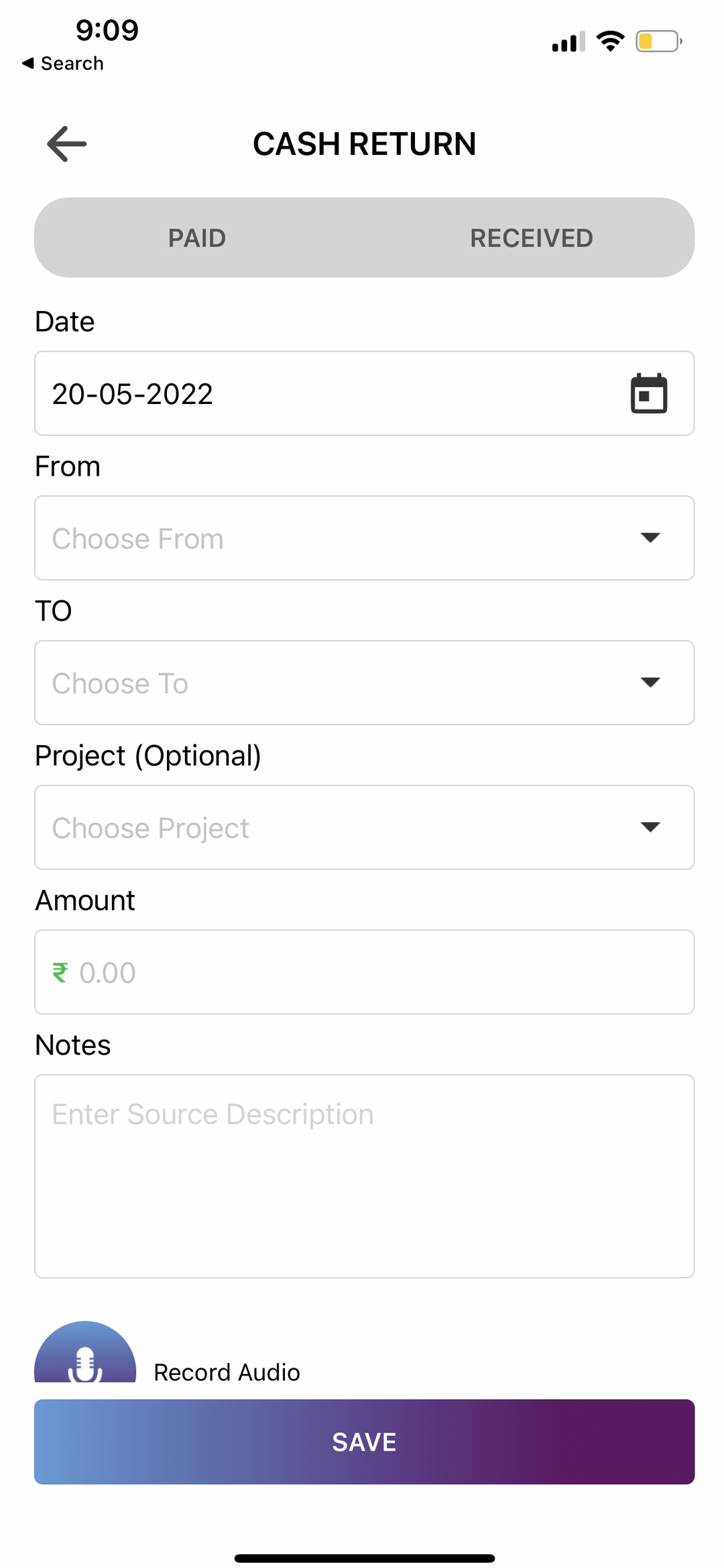

For mobile users, Mint has $0.99 upgrade that eliminates ads, and on iOS you get extra features with Mint Premium at $4.99 a month. Mint’s services are free, but at least one feature – bill negotiation – has an extra fee, and you’ll have to endure a steady diet of financial offers. Part of Intuit’s stable of financial products, which includes TurboTax and QuickBooks, Mint has been around since 2006. Among those tools is the one that makes this one of the best budgeting apps we tested: The ability to create multiple budgets to view your spending across different categories. Intuit Mint provides a robust set of automated tools for tracking your personal finances. Read the rest of our Simplifi by Quicken review. Unlike its well-known personal finance sibling Quicken, Simplifi began life as a web-first service, and its graphical look and feel reflect that history.

The service handles account tracking across banks, investments, and credit cards and payment services, and combines this with spending and savings plans, bill alerts, and trends analysis of your spending, income, savings, and more. Whereas Quicken is a full-scale personal financial package with desktop applications and online/mobile support, Simplifi pares things back to basics, and it does so with a fresh, visually appealing interface and logical workflow to tracking accounts, setting savings goals, and creating budgets. Now owned by Aquiline Capital Partners, Simplifi comes from the same stewards of long-time stalwart Quicken. This cloud-based service makes it easy to track your money and budget wherever you are. Simplifi by Quicken is, as its name implies, a simplified approach to personal finance.

We make it industry-specific for you as part of the app’s deployment.īusiness-owned After deployment your FP&A team is able to own the app and make enhancements if and where needed.Lacks support for complex annual budgets or tax planning Making it industry-specific isn’t a big thing. We make it industry-specific for youThe Cash Flow Forecasting app is industry-independent.

Cashflow management apps free#

Intelligent scenario models The Cash Flow Forecasting app features intelligent accounting and financial management rules that provide valuable and realistic insights into the evolution of cash flow and balance sheet under different scenario models.īusiness-relevant insights The cash flow and balance sheet models feature relevant insights into topics like working capital, free cash flow, and net debt, speaking a language that is valuable for the financial management of your company. Quick to deploy Seed your income statement forecast into the Cash Flow Forecasting app and you’re quickly under way to build your cash flow and balance sheet scenario models. Graphs that visualize monthly cash levels for each of the scenario models, monthly net debt levels for each of the scenario models, waterfall analysis of net cash flow for the year, and waterfall analysis of free cash flow for the year.Īdvantages of the Cash Flow Forecasting app.Balance sheet forecasts providing relevant insights into monthly working capital levels, total capital employed, net debt levels, and total funds provided.Automatic drawing of additional funds in case the cash levels drop below what is considered the minimum cash required to operate, providing valuable insights when additional funds are needed and what those funding needs are.Modeling of other investing and financing activities, including mandatory debt repayments.

0 kommentar(er)

0 kommentar(er)